Anheuser-Busch (NYSE: BUD), Molson Coors (TAP), and Constellation Brands (STZ) are rushing to catch up to other big alcoholic beverage industry brands in the ready-to-drink (RTD) and hard seltzer category. For startup companies looking to cash out quickly, this race between large beverage companies to acquire RTD market share is creating a once-in-a-lifetime opportunity.

Chris Graebe of Boardroom Investment Group said his alcoholic beverage startup company, which currently has three RTD products, is seeing action unlike any of his previous investment ventures.

“It’s on one of the fastest sales and expansion tracks I’ve seen.” – Chris Graebe

The answer to why RTD small companies and startups are so hot at the moment is simple; it appears that the rapid rise of RTD cocktails and hard seltzers in the alcoholic beverage market caught some big beer and wine companies off guard.

“They were slow to invest in these new products and allowed startups to lead the way,” Graebe said. “But now, the industry-leading companies are jumping into the game full force, acquiring startups left and right to catch up.”

This leaves a ripe opportunity for savvy startups to cash out big and quickly. According to Graebe, big brands are particularly interested in startups and small companies that speak to Millennial tastes. They hope that by bringing aboard young talent with fresh ideas, they can rein in control of the RTD and hard seltzer category.

“[Startups] can go from inception to exit in a short time if they bring something new to the market,” said Graebe.

A pattern of swift acquisition has made itself apparent across large wine, spirit and beer brands alike. This is in part due to increased popularity in direct to consumer (DTC) marketing and e-commerce sales in the alcoholic beverage sector, which thrive on modern marketing strategies and value no-fuss simplicity.

“Robert Hanson, president of Constellation’s wine and spirits division noted that DTC is a much smaller portion of the company’s portfolio than they would like it to be,” Graebe said. “Seeing the growing demand for DTC and e-commerce brands, Constellation began a quest to expand into this market.”

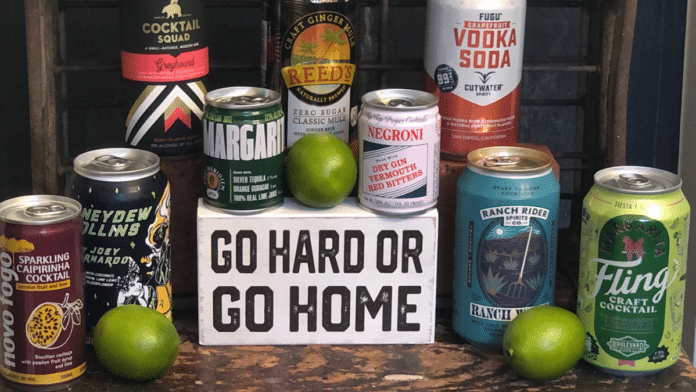

Similarly, AB InBev is also looking to diversify and add more direct-to-consumer brands to its portfolio. Recently, the beer company acquired Cutwater Spirits, which makes a line of several RTD cocktail products.

“[AB InBev] wants to move into other niches in the market, namely RTDs,” Graebe explained. “This purchase comes after a series of diversifying and modernizing plays by the company such as acquiring organic energy drink Hiball and sparkling juice Alta Pall, buying the beer rating website RateBeer.com, and investing in the research of THC and CBD beverages.”

Graebe had some wise words to share with entrepreneurs looking to cash in on this RTD startup acquisition boom.

“If the biggest brewer in the world (AB InBev) sees the potential in the RTDs and other emerging sections of the adult beverage market and is willing to invest billions to get in on it…I think you too should be paying attention,” Graebe said. “I know I am!”

- Podcast: New Realm’s Mitch Steele Talks Hard Seltzer - March 8, 2021

- Big Brands Bring Awareness with Publicity — in the Market or in the Courts - February 27, 2021

- Naked Seltzer Betters the Home Bar - February 26, 2021