This Content Is Only For Subscribers

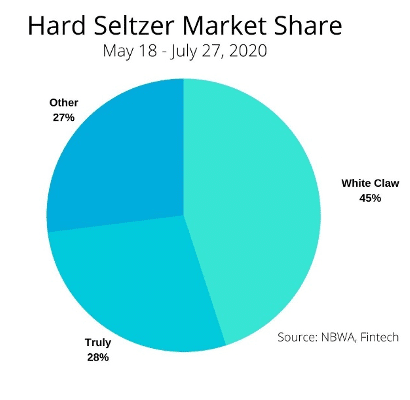

A key risk to Anheuser-Busch InBev (ticker: ABI), Constellation Brands (ticker: STZ), and Molson Coors Beverage Company (ticker: TAP) is their inability to take market share from White Claw and Boston Beer’s (ticker: SAM) Truly brands.

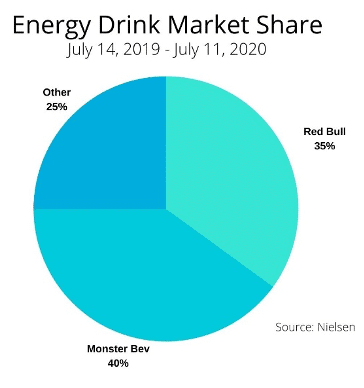

Comparing a view of the US energy drink market brings concern. Coca-Cola (ticker: KO) opted to partner with Monster Energy in 2015, handing over its struggling energy drink brands as a part of a larger deal. PepsiCo (ticker: PEP) acquired Rockstar Energy beverages after lagging in the energy drink category for years. The inability of these large-cap soft drink manufacturers to organically break into a growing adjacent category is a fate that ABI, STZ, and TAP could face.

However, the hard seltzer subcategory stands to buck the trend. Perhaps it will not be subject to the same headwinds as the soda mega-caps faced, given a different go-to-market strategy. The big breweries are relying on legacy brand names to create an entirely new product that goes head-to-head with White Claw and Truly brands. Coke and Pepsi approached energy drinks with hybridization-like model (soda-energy crossover), with partnerships limiting their ability to directly compete.

However, the hard seltzer subcategory stands to buck the trend. Perhaps it will not be subject to the same headwinds as the soda mega-caps faced, given a different go-to-market strategy. The big breweries are relying on legacy brand names to create an entirely new product that goes head-to-head with White Claw and Truly brands. Coke and Pepsi approached energy drinks with hybridization-like model (soda-energy crossover), with partnerships limiting their ability to directly compete.

- Going Beyond the Can: Packaging Hard Seltzer - August 17, 2020

- Driven by Convenience, Accelerated by COVID, and Here to Stay - August 17, 2020

- Female Founder Shaking Up the Booze Business - August 17, 2020