Much anticipation surrounds the upcoming Q3 2020 earnings reports by Anheuser-Busch (NYSE: BUD) and Molson Coors (NYSE: TAP), to be released pre-market hours on Thursday, October 29. The Boston Beer Company (NYSE: SAM) surprised markets with earnings reports on Friday, leading to a stock price soar of 18% and an all-time high.

Both companies have been hurt by the abrupt closure of on-premise outlets that serve their beer products. Another significant challenge in the second quarter was the aluminum can shortage, which lead to out-of-stocks and created and opportunity for smaller local competition.

However, new Ball can plants have come online, and both companies have taken rapid steps to diversify into “beyond beer” beverages, such as hard seltzer, which are packaged, rather than kegged, and have an at-home following skew. This time last year, Molson Coors went so far as to change their name from Molson Coors Brewing to Molson Coors Beverages Company.

Anheuser-Busch Earnings vs Last Quarter and Last Year

Anheuser-Busch will report earnings on 10/29/2020 before the stock market opens. The report will be for its fiscal quarter ending September 30, 2020. According to Zacks Investment Research, the consensus EPS forecast for the quarter is $0.73.

Anheuser-Busch Inbev last released its quarterly earnings data on Thursday, July 30th, 2020.

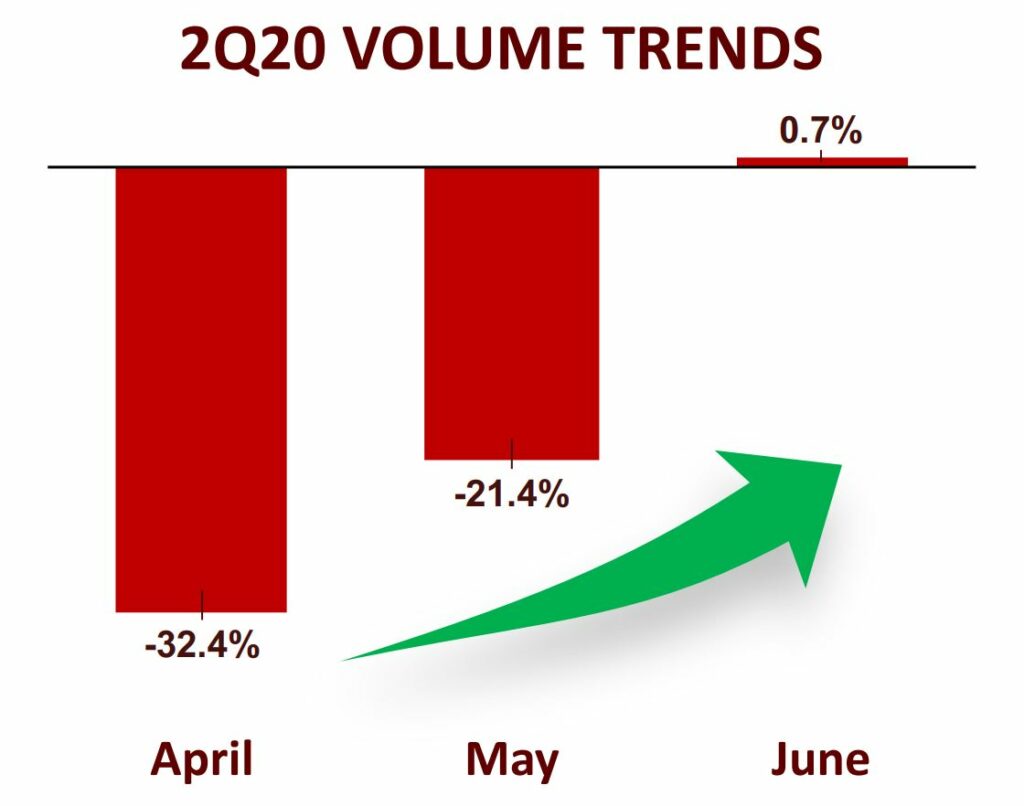

The company’s Q2 results showed movement towards positive territory. After declines in April and May, June volume was actually up by 0.7% vs prior year. They reported earnings per share (EPS) of 46 cents, reflecting a decline of 61% from second quarter 2019. However, earnings beat the Zacks Consensus Estimate of 31 cents, or a surprise of 48.4%. The stock rose from Monday to Thursday of that week by $4.00 per share, or a gain of 7.4%.

Molson Coors Earnings vs Last Quarter and Last Year

Molson Coors Beverage Company will report third quarter earnings on Thursday, October 29, before markets open. Zacks Investment Research, based on 6 analysts’ forecasts, predicts EPS for the quarter at $1.04.

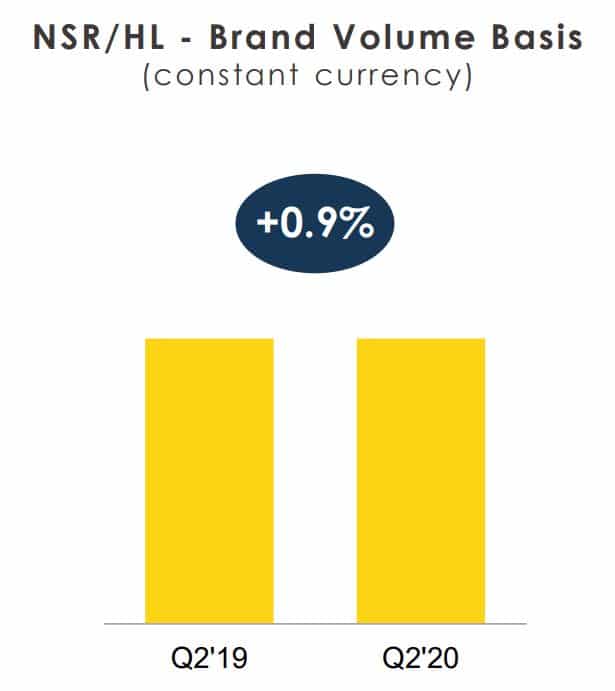

Molson Coors committed to preserving marketing spend in the second half of 2020 in their earnings call on July 30, 2020. The company benefitted from positive trends in the on-premise channel in some markets in June, while its UK business remained adversely affected until early July. The company stated at the time that they expected uncertainty to continue in the quarters ahead regarding the return of business to pre-COVID-19 status. At the earnings call on July 30, the company expected adverse impacts on top and bottom lines for Q3, H2, and beyond.

Even in the midst of such uncertainty brought on by the coronavirus pandemic, based on what we have seen and what we have done, we intend to maintain the strength of our iconic brands, grow our above premium business and expand beyond the beer aisle. – Gavin Hattersley — President and Chief Executive Officer, Molson Coors Beverage company, on July 30, 2020

- ThirstyFrog Sets Sail - September 7, 2022

- Tell Me Whey: Dairy Hard Seltzer Developed by Cornell Scientist - July 24, 2022

- Constellation Brands Expected to Announce Significant Quarterly Increase in Sales - September 27, 2021