DoorDash, the home delivery giant, provided a first-look into company financials as the firm begins to move from private to public. An IPO is expected by the end of 2020.

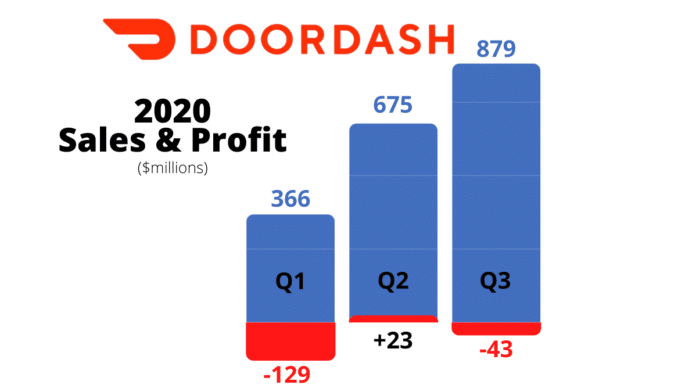

In paperwork filed Friday, the company is still not profitable on YTD sales, but did ebb to black in the second quarter, where it posted a profit of $23 million on $675 million in sales.

But does it take a pandemic for success?

Third quarter numbers were not as kind. Sales were up to $879 million, but DoorDash posted a loss of $43 million in the period ending September 30. YTD sales came in at $1.92 billion.

The IPO filing occurred earlier in the year, with expectations at the time of going public sometime before the end of June.

While the coronovirus delayed many corporate business plans, the fact is that home delivery of food has benefited greatly. With restaurants largely closed, and now even only at reduced occupancy, services like UberEats, GrubHub, and DoorDash provided something of a lifeline to prepared meals — and alcohol.

DoorDashers can deliver alcoholic beverages if certain criteria are met. The Dasher has to be of legal age, and the recipient has to show valid ID at time of pick-up. Failure to produce valid identification will sock you with a $20 restocking charge. Dashers are presented with guidelines, so as to avoid delivering to a college campus or anyone who is clearly intoxicated.

The recent ruling by the State of California gives all home delivery services a boost. On Nov. 3, Proposition 22 passed easily, allowing Uber, Lyft, DoorDash and others in the gig economy to protect their contract worker business model.

- ThirstyFrog Sets Sail - September 7, 2022

- Tell Me Whey: Dairy Hard Seltzer Developed by Cornell Scientist - July 24, 2022

- Constellation Brands Expected to Announce Significant Quarterly Increase in Sales - September 27, 2021