Hard seltzer’s premium image sits in juxtaposition to the adjacent canned malt beverages of the past. Drinkers think of it as a new category, marked by its premium image & convenience: “a convenient way to have a cocktail” is why over 50% of drinkers opt for the product, says Nielsen.

The category’s growth has been fueled by taking wallet share largely from beer and wine, with Nielsen data seeing beer/wine losing 5.6/4.0 points of this consumer group’s market share in March and April 2020, vs 2019. While beer is being challenged, drinkers shifting into the beer/FMB/cider market from wine should be a positive for brewers if they capitalize. 75% of hard seltzer drinkers also buy beer, and the rollout of brand extension hard seltzer names (Bud Light, Coors, Corona) should lead to the opportunity for brand cross-pollination.

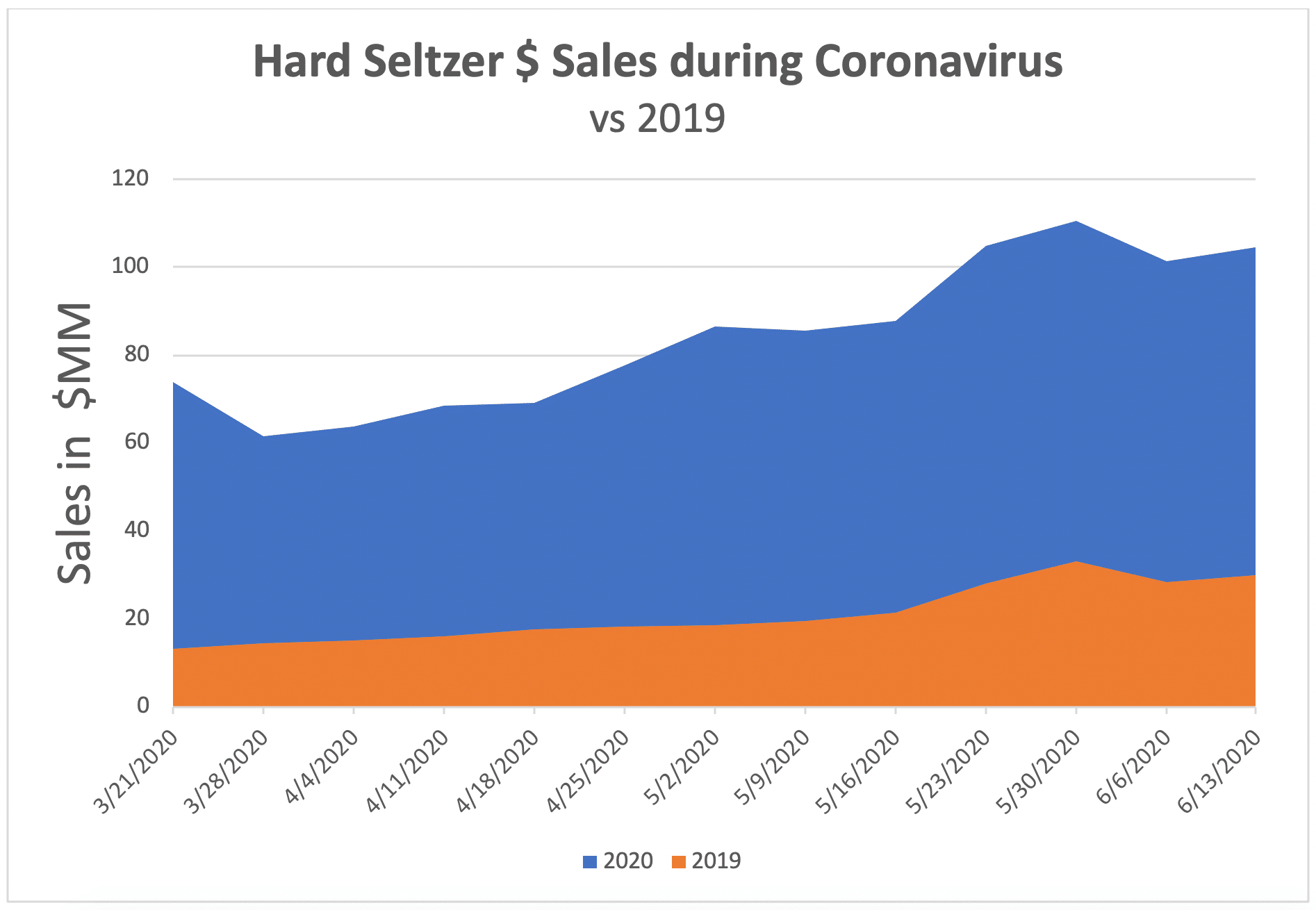

The COVID lockdown and related shift to off-premise alcohol sales (hard seltzer’s current strong suit) have accelerated hard seltzer’s rise. It’s dollar share of total beer/FMB/cider now exceeds over 10%, up from 4.4% of share during the 52-week period ending February 29, 2020. 44% of hard seltzer purchasers from March 1 through April 25 were new buyers, and sentiment/purchasing statistics show that these new drinkers are not going anywhere.

Nearly 75% of on-premise buyers state that they believe the sub-segment will continue to grow in popularity, and brands are experiencing higher-than-average repeat purchase rates. Corona Seltzer posted almost 80% in Q2.

- Going Beyond the Can: Packaging Hard Seltzer - August 17, 2020

- Driven by Convenience, Accelerated by COVID, and Here to Stay - August 17, 2020

- Female Founder Shaking Up the Booze Business - August 17, 2020