A recent survey of 3,500 consumers shed some light on the buying habits of active Millennial population in the US.

COVID-19 has changed buying behavior forever, as necessity has nudged consumers down paths previously untrodden.

Nielsen data shows stay-at-home consumer goods sales have skyrocketed, such as dish soap rising by 34% in year-over-year growth since the pandemic struck. With online sales of grocery items securing a 10.2% share of sales in 2020, the industry isn’t looking back. Mercatus data predicts the share will now rise to over 20% by 2025.

A majority of Millennials now prefer buying groceries online, and over a third of Gen Z consumers say they’ve been buying food and beverages online more than pre-COVID.

With Instacart now covering more than 85% of US households, the home delivery infrastructure is firmly in place for continued growth.

The new behaviors associated with online buying have implications for retails and brands. It can become harder for a new brand to gain attention, as over 54% of Millennials surveyed by Toluna reportedly start their online shopping trip by clicking on their previous order.

The Future is Brighter

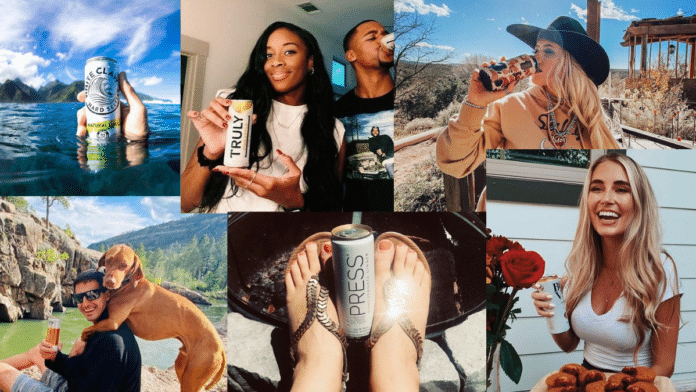

IWSR data has a brighter outlook that originally forecast. While the total alcoholic beverage market will undoubtedly decline in 2020, data now indicates a softening of just 8%. But the future looks bright for ready-to-drink cocktails and hard seltzer. 2020 will see a global increase of approximately 43%.

Millennials Moving from Craft Beer

In fact, Millennials are now drinking more hard seltzer than craft beer. 45% vs 42%. Coming in at third place behind Big Beer and wine, hard seltzer is a category that has been propelled by its broad reach in branding, relatively low ABV, and lower in calories and carbs.

Those healthy options resonate with an audience that has been forced to give up their gym memberships due to social distancing. According to the survey 45% answered that they are drinking less alcohol since the pandemic started.

It’s possible that craft beer producers created the problem. Veering away from data that indicated consumers wanted less (calories, carbs, alcohol), the industry doubled-down on crazy blends, imperial strengths, and calories in the stratosphere.

Premium brands stand to gain from the new behaviors, with 72% of earners $150,000/year and greater stating they’ve been eating healthier in the new norm.

- ThirstyFrog Sets Sail - September 7, 2022

- Tell Me Whey: Dairy Hard Seltzer Developed by Cornell Scientist - July 24, 2022

- Constellation Brands Expected to Announce Significant Quarterly Increase in Sales - September 27, 2021